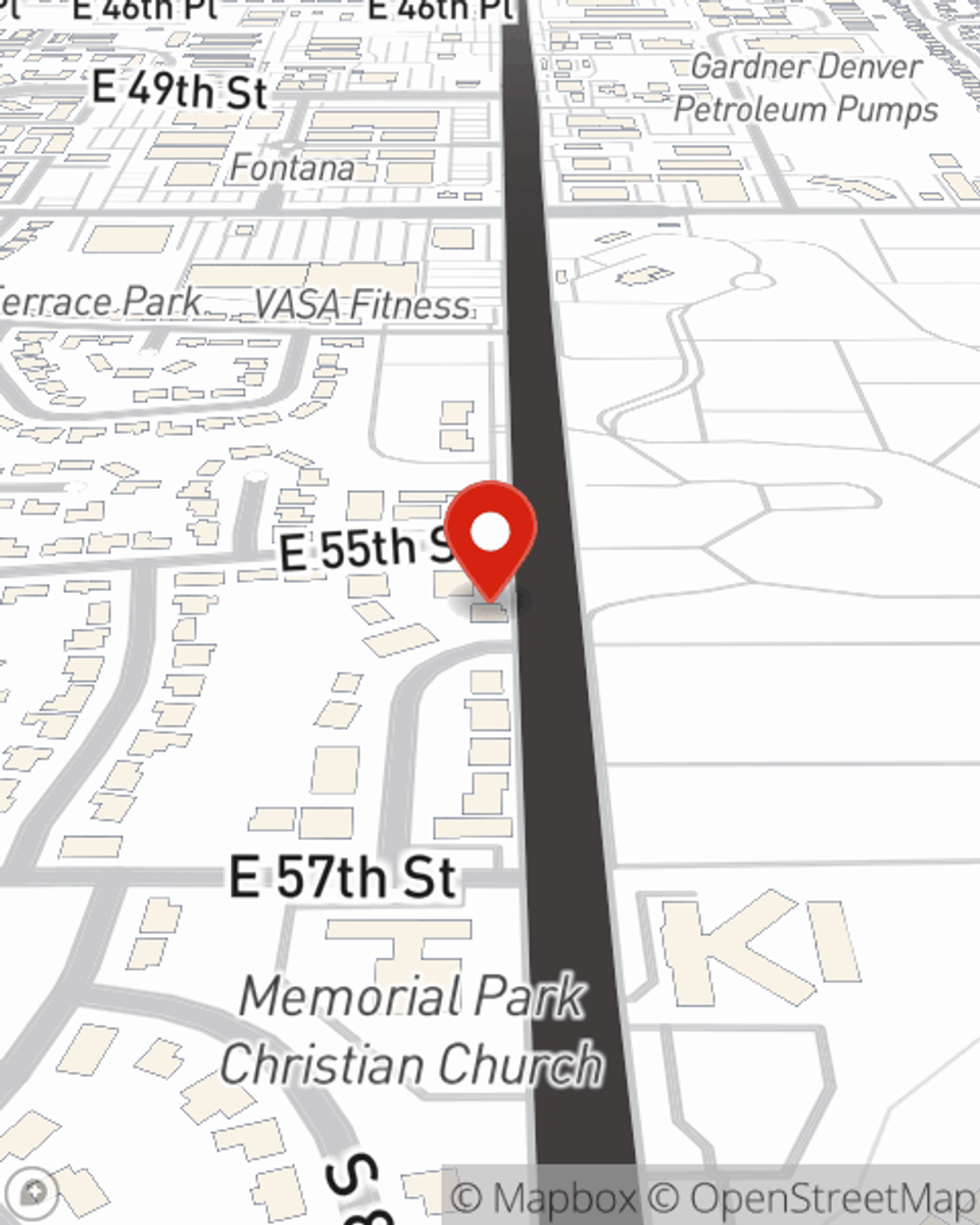

Business Insurance in and around Tulsa

Looking for small business insurance coverage?

Helping insure small businesses since 1935

This Coverage Is Worth It.

Being a business owner is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for the ones you care for. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, extra liability coverage and worker's compensation for your employees.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Protect Your Future With State Farm

Your company is one of a kind. It's where you earn a living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a store or a shop. Your business is an extension of yourself. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers a wide range of occupations like an HVAC contractor. State Farm agent Mark Welty is ready to help review coverages that fit your business needs. Whether you are a drywall installer, an HVAC contractor or a real estate agent, or your business is a candy store, a travel agency or a bagel shop. Whatever your do, your State Farm agent can help because our agents are business owners too! Mark Welty understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Contact agent Mark Welty to review your small business coverage options today.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Mark Welty

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?